Your current location is:Fxscam News > Exchange Dealers

IMF: A U.S. Strike on Iran Could Lower Global Growth

Fxscam News2025-07-23 08:15:12【Exchange Dealers】2People have watched

IntroductionForeign exchange platform comparison,Foreign Exchange Online Trading Official Website,IMF Warns of Escalation in Middle EastKristalina Georgieva, Managing Director of the International M

IMF Warns of Escalation in Middle East

Kristalina Georgieva,Foreign exchange platform comparison Managing Director of the International Broker Detectorry Fund (IMF), stated on Monday that U.S. strikes on Iranian nuclear facilities have heightened global uncertainty and could trigger wider risks beyond the energy market. She noted, "We are already in a highly uncertain world, and now there is a new variable."

Georgieva mentioned that while the most notable impact currently is on energy prices, "there could be secondary or even tertiary effects," especially if the situation escalates further, posing growth risks to major economies and leading to revised global economic growth forecasts.

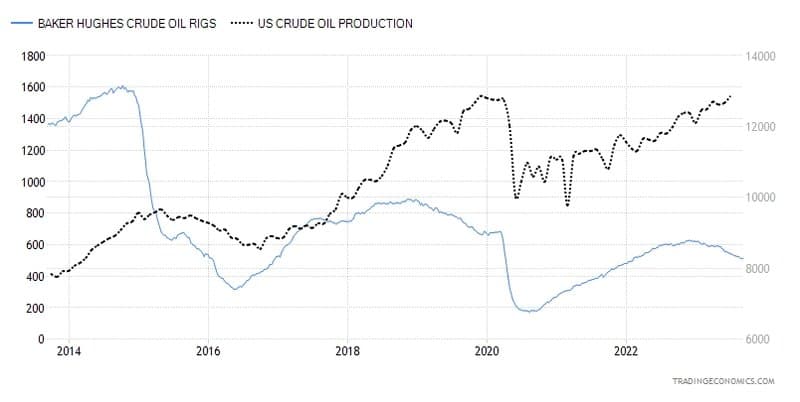

Oil Price Volatility Sparks Market Attention

Amid worsening geopolitical tensions, Brent crude oil futures soared by 5.7% during the early Asian trading on Monday, reaching $81.40 per barrel, before plunging dramatically in intense trading. This unusual volatility reflects increasing market concerns over potential disruptions in Middle Eastern supply.

The IMF is closely monitoring the risk premiums of oil and natural gas. Georgieva pointed out that the surge in current option trading volumes and changes in the futures curve indicate expectations of short-term supply tightness. She emphasized that whether transportation disruptions or spillovers to other countries occur is a key focus at present.

Global Growth Forecast Faces Downward Revision Risk

In April, the IMF had already downgraded global economic growth forecasts, warning that the trend of global trade restructuring led by the U.S. poses long-term challenges. Georgieva indicated that although a global recession has been avoided, rising uncertainty may weaken the willingness to invest and consume, hindering growth.

She said, "Uncertainty affects investors' and consumers' decisions. When they stop investing or spending, the economy slows." This is why geopolitical tensions need special vigilance.

US Economy Stable but Not Yet Ready for Rate Cuts

Regarding the U.S. economic situation, Georgieva stated that inflation in the U.S. shows signs of receding, but the Federal Reserve requires more evidence to initiate rate cuts. She expects that by the end of the year, the Federal Reserve might be in a position to consider rate reductions.

She also highlighted that the U.S. labor market remains strong, with steady wage growth, continuing to support consumption momentum. However, if international market turmoil spreads, this support could face challenges.

IMF Calls for Attention to Ripple Effects and Confidence Shocks

Georgieva concluded by stating that the IMF is assessing whether the current situation could evolve into a broader economic shock. "We must watch whether energy routes are disrupted and how financial markets respond."

She stated that the global economy is "still bearing the pressure," but confidence is fragile. If geopolitical tensions further escalate, the impact on investment and consumption could swiftly transmit, leading to a global economic slowdown.

"I pray that the worst does not happen," she added.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(1831)

Related articles

- Australia's ASIC Releases Latest Investor Warning List, What Risks Are Involved?

- Korean won depreciation fuels inflation, political turmoil deepens economic challenges.

- The euro fell to a two

- The Bank of Japan may announce its largest rate hike in 18 years.

- Market Insights: Jan 19th, 2024

- Offshore yuan rebounds, regains five major thresholds, with stable exchange rate policy in focus.

- The euro risks parity with the dollar; CPI and ECB decision are key.

- Gold may hit a 2025 record, driven by geopolitics and central bank buys.

- The Spanish National Securities Market Commission (CNMV) warns four unregistered entities.

- Russia starts using Bitcoin for trade; Finance Minister sees digital payments as the future.

Popular Articles

Webmaster recommended

Plexytrade is a scam platform: Don't be fooled!

Dollar falls, euro rises amid Fed policy focus and Russia

The US imposes a 25% tariff on Canada and Mexico, which may affect commodities such as oil.

The US dollar reached a two

AXEL PRIVATE MARKET Broker Review: High Risk (Illegal Business)

Analysts warned that the Canadian dollar’s rebound is unstable due to tariffs and rate differentials

The dollar hit a seven

Dovish Fed officials: Rate cuts are feasible, but the pace should slow.